On April 5, 2024, after an eight-day trial, a jury in the U.S. District Court for the Northern District of California returned a verdict for the Securities and Exchange Commission in its first “shadow trading” case after deliberating for just over two hours.

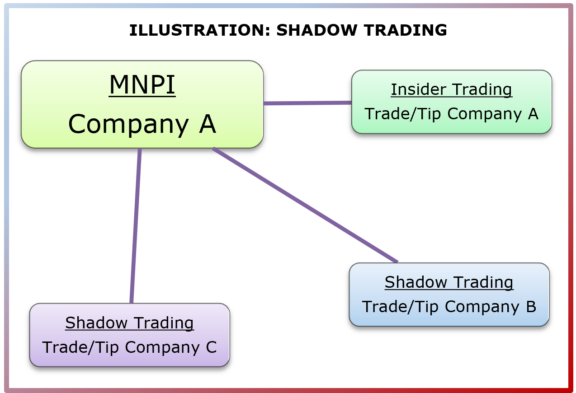

“Shadow trading” has become shorthand for trading in the securities of Company B (or C or D or…) while in possession of material nonpublic information (MNPI) from Company A. The term was coined by academics in connection with a study showing that public company insiders tend to fare better than the average investor when trading in the securities of their corporate competitors.

In this case, the SEC alleged Matthew Panuwat, a business development executive at Medivation, Inc., an oncology-focused biopharmaceutical company, traded in the securities of Medivation’s competitor, Incyte Corporation, after learning Medivation would be acquired by Pfizer, Inc. That is, within minutes of learning the news, Panuwat bought short-dated, out-of-the-money call options on Incyte. Four days later, after the announcement of the acquisition, Incyte’s shares rose 8%, earning Panuwat profits of $107,066.

On January 18, 2022, the Court, in denying Panuwat’s Motion to Dismiss, found:

The SEC’s allegations fit under two underlying principles: that the misappropriation theory reaches trading by corporate outsiders… and that information may be material to more than one company. The first is grounded in precedent, the second in common sense. Panuwat may dispute the number of companies to which information may be material, but… the relevant caselaw does not foreclose the possibility that the number exceeds two.

On Nov. 20, 2023, in denying Panuwat’s Motion for Summary Judgment, the Court found the following questions remained for trial:

-

- Materiality: Whether a “market connection” existed between the two companies or whether the companies were “economically linked.”

- Public/Nonpublic: Whether the email from Panuwat’s CEO with information about the final buyer, price, and timing of the merger “was different enough—and more detailed than—the information available to the market, making it nonpublic information.”

- Breach of Duty: Whether Panuwat breached (i) Medivation’s Insider Trading Policy, (ii) a confidentiality agreement he signed when hired, or (iii) a common law duty created when his employer entrusted him with confidential information.

- Scienter: Whether Panuwat knowingly misappropriated the confidential information from his employer.

To find Panuwat civilly liable for insider trading, the jury therefore had to find that Panuwat, as a result of his employment at Medivation, had nonpublic information that was material to Incyte, that he bought the Incyte call options on the basis of that information, which he knew to be confidential and material, and that, in doing so, he knowingly or recklessly breached a duty to Medivation. Potential penalties are scheduled to be discussed at a hearing on April 17.

S&K Observations

After more than 40 years of thinking about, identifying, and establishing and maintaining policies and procedures for the appropriate handling of MNPI and potential MNPI, and to safeguard against its possible misuse, including insider trading, it is clear we must think about those requirements and risks in a new, more expansive way.

We recommend all SEC registrants, including investment advisers, private fund managers, and other asset managers review existing policies and procedures to ensure they capture the concept of shadow trading and associated risks, revise policies or procedures as needed, and train all supervised persons on them and on how to identify shadow trading risks.

If you have any questions regarding the matters covered in this, please contact Philip Moustakis or Jaimie Nawaday, or your primary Seward & Kissel attorney.