This memorandum is for our Capital Markets clients in anticipation of the upcoming annual reporting and shareholder meeting season for 2024. Below you will find key filing deadlines, new disclosure requirements, and general tips and guidelines for both U.S. domestic and foreign private issuers.

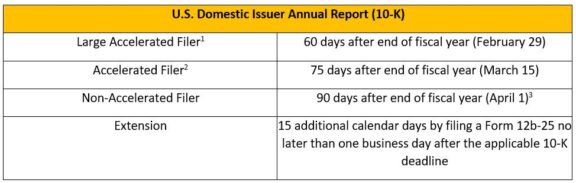

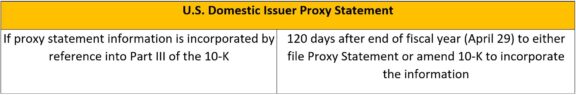

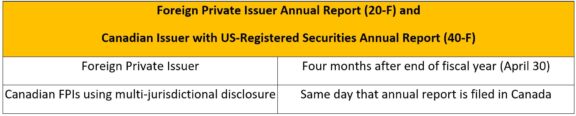

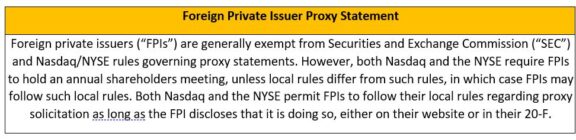

Filing Deadlines

Please see the following tables for important deadlines. Dates in the tables below are for issuers who use the calendar year end as their fiscal year end (December 31).

New Requirements

10b5-1 Plans and Related Disclosure

During 2023, the SEC’s amendments to Rule 10b5-1 of the Securities Exchange Act of 1934 (the “Exchange Act”) and its related disclosure requirements for public companies became effective. Rule 10b5-1 establishes a safe harbor against insider trading violations for trades that were completed according to a written plan that was adopted in good faith when the person was not aware of Material Non-Public Information (“MNPI”). The amendments imposed the following additional requirements.

- Cooling-Off Periods. A director or officer cannot trade under a Rule 10b5-1 plan until the later of: (i) 90 days after adopting or modifying-a plan or (ii) two business days after the issuer files its 10‑Q or 10-K (for FPIs, a 6-K containing financial results or 20-F) for the fiscal quarter during which the 10b5-1 plan was adopted or modified (but no later than 120 days after adoption or modification of the plan). Persons that are not directors or officers are subject to a 30-day cooling-off period following the adoption or modification of a plan. Modifications that do not alter the sale or purchase price, the quantity of securities to be purchased or sold, or the timing of trades do not trigger the cooling off period.

- Director and Officer Certifications. Directors and officers must certify in their 10b5-1 plans when they are adopted or modified that (i) they are not in possession of MNPI and (ii) the plan is being adopted in good faith and not as part of a scheme to evade the insider trading laws.

- Good Faith Requirement. The good faith obligation extends beyond the adoption of a 10b5-1 plan, requiring the insider to continue to act in good faith through the entire duration of the plan.

- Restrictions on “Overlapping” Plans. Insiders may not have more than one plan in effect covering trades during the same time period, subject to certain exceptions. Additionally, an insider may have only one single-trade plan during any 12-month period. These restrictions do not apply to an issuer’s 10b5-1 plans.

Issuer Disclosure

If any director or officer has, during the most recent fiscal quarter, adopted, modified or terminated a 10b5-1 plan (or a pre-arranged trading plan that does not qualify as a 10b5-1 plan), the issuer must disclose in the 10-Q or 10-K for that quarter (or 6-K or 20-F for foreign private issuers) the material terms of the plan, including: (i) the name and title of the director/officer, (ii) the date on which the plan was adopted or terminated, (iii) the duration of the plan and (iv) the aggregate number of shares that are subject to the plan. Issuers are not required to disclose the authorized trading prices under the plan.

An issuer must also disclose annually (in a 10-K and Proxy or in a 20-F) whether it has adopted any policies related to insider trading and include them as an exhibit. If the issuer has not adopted a policy, it must explain why. Seward & Kissel recommends updating annual Director and Officer questionnaires to elicit such information.

Under new Item 402(x) in Regulation S-K, a U.S. domestic issuer must disclose in its 10-K and proxy, its policies and practices regarding the timing of stock option grants around its release of MNPI to the public, including a description of how the issuer’s board determines when to grant the awards.

Item 402(x) also requires a U.S. domestic issuer to provide tabular disclosure of equity awards granted to any Named Executive Officers within four business days before and one business day after filing a 10-Q or 10-K or filing an 8-K that contains MNPI. This disclosure must also include the change in market price of securities from one trading day before to one trading day after the disclosure of MNPI.

The SEC adopted amendments to Form 20-F requiring FPIs to provide similar disclosures regarding their insider trading policies and procedures.

Director, Officer & 10% Shareholder Disclosure

Section 16 reports on Forms 4 and 5 must now indicate, by checkbox, whether a trade is under a 10b5-1 plan, and the date that plan was adopted. In addition, dispositions by a bona fide equity gift must now be reported on Form 4 within two business days, instead of on Form 5 after year end. The SEC clarified that the affirmative defense under Rule 10b5-1(c)(1) is still available for bona fide gifts of equity securities.

Timing

- The new requirements for 10b5-1 plans became effective on February 27, 2023. Rule 10b5-1 plans that already existed are not affected unless they were modified after February 27, 2023.

- The new disclosure requirements for issuers became effective for the first full fiscal period beginning on or after April 1, 2023. This means the quarterly disclosure regarding 10b5-1 plans began for quarters ending June 30, 2023, but disclosures required annually do not apply until the annual report for fiscal years ending on or after March 31, 2024. Accordingly, a company with a December 31 fiscal year end would not have to file its insider trading policies or option award policy or table until its 10-K or 20-F for the 2024 fiscal year, but it would need to disclose changes in 10b5-1 plans for the fourth quarter of 2023 in its upcoming 10-K or 20-F. In addition, smaller reporting companies are afforded an additional six months to comply.

- The Section 16 changes became effective on April 1, 2023. FPIs are not subject to Section 16.

Issuer Share Repurchases

The SEC adopted new quantitative and narrative disclosure requirements regarding share repurchases that were meant to come into effect later this year for U.S. domestic companies and in the middle of next year for foreign private issuers. On December 19, 2023, the Fifth Circuit vacated the proposed changes after the SEC failed to adequately address concerns with the rule within the 30 day window they were given to do so. The SEC has not indicated as of the date of this Client Alert whether it will appeal the Fifth Circuit decision, and therefore the future of these proposals remains uncertain.

The proposed changes included (i) quantitative disclosure regarding share repurchases; (ii) a checkbox indicating whether any executive officer or director traded shares within four business days before or after the issuer announced the establishment of or increase in a repurchase plan; (iii) narrative disclosure of items such as the objectives or rationales for the repurchase program; and (iv) disclosure about the issuer’s adoption or termination of any Rule 10b5-1 plan, including that plan’s material terms. The quarterly disclosures discussed in this paragraph may be made in periodic reports in an 8-K or 6-K or annual reports in a 10-K or 20-F.

For further information on the proposed and now vacated changes, please refer to our Client Alert on Issuer Share Repurchases, which can be found here.

Board Diversity

Nasdaq provided updates for Rules 5605 and 5606 regarding board diversity disclosure to provide new and clearer deadlines tied to December 31, including two deadlines as of December 31, 2023.

- Board Diversity Matrix – A company must provide tabular disclosure of its board diversity information by December 31, starting with initial disclosure by December 31, 2023. A company has to provide this information either (a) in any proxy statement or information statement or, if it does not file a proxy, in its Form 10-K or 20-F or (b) on the Company’s website, while concurrently submitting to Nasdaq the disclosure along with a link to its location on the website.

- Diverse Board Members – Nasdaq’s board diversity rules establish diversity objectives for its listed companies and require each listed company to disclose whether it has met these objectives and if it has not done so, to explain why. The objectives are for a listed company to have at least two diverse board members consisting of one that is female and one that is either LGBTQ+ or an “underrepresented minority.” The update clarifies that a company listed on any Nasdaq market must disclose whether it has at least one diverse board member (or why it does not have one diverse board member) by December 31, 2023; a company listed on the Nasdaq Global Market or Global Select Market must disclose whether it has at least two diverse board members (or why it does not) by December 31, 2025, with companies listed on the Nasdaq Capital Market having until December 31, 2026 to make this disclosure. As with the board diversity matrix, this disclosure can be made in a proxy or information statement (or annual report) or a company can post it on its website with simultaneous notice to Nasdaq.

Electronic Filing of “Glossy” Annual Reports

Under Regulation 14A of the Exchange Act, a reporting company must provide an annual report to its shareholders if the company is soliciting proxies for a shareholder meeting at which directors will be elected. This report is often referred to as the “glossy” annual report (due to the glossy paper on which it is typically printed). It has also become common to use the 10-K to satisfy this requirement by having a glossy cover page or letter to shareholders “wrapped” around the 10-K.

In June 2022, the SEC adopted amendments to Rule 101 of Regulation S-T to require an issuer to file these annual reports on the SEC’s EDGAR System, including both glossy annual reports and annual reports that merely wrap the issuer’s 10-K. This replaces the SEC’s 2016 guidance, which allowed a company to post its annual report on their corporate website for at least one year instead of providing paper copies to the SEC. Paper submissions to the SEC of the annual report are now prohibited, and providing the annual report through the company’s website is now optional. However, companies must still post a copy of the annual report to at least one website other than EDGAR under Rule 14a-16(b) of the Exchange Act. The annual reports must be submitted in PDF format, using EDGAR Form ARS. The PDF must have the same graphics, styles of presentation and text size, placement, color and offset for disclosures, as in the annual report sent to shareholders. For foreign private issuers, the electronic filing rules only apply to documents in a 6-K.

Cybersecurity Incident Reporting

The SEC adopted new rules aimed at enhancing cybersecurity incident reporting by public companies, which will be required to disclose in annual reports in a 10-K or 20-F, the internal processes for assessing, identifying and managing material cybersecurity threats; and in periodic reports in a 8-K or 6-K, any “material cybersecurity incident.” This disclosure is required to be included beginning with annual reports for fiscal years ending on or after December 15, 2023, as detailed more fully in our Client Alert found here.

Clawback Policy

During the year, the SEC approved new NYSE and Nasdaq rules regarding an issuer’s obligation to claw back erroneously awarded, incentive-based, executive compensation. These rules became effective October 2, 2023, with issuers needing to adopt compliant policies no later than December 1, 2023. Please refer to our clawback policy memorandum for more information, which you can find here.

Section 13(d) and 13(g) Beneficial Ownership Reporting

On October 10, 2023, the SEC issued its final rules modernizing beneficial ownership reporting under Sections 13(d) and (g) of the Exchange Act of 1934. While revised 13D reporting obligations will not take effect until 90 days after their publication in the Federal Register (no earlier than January 2024) and revised 13G not be required before September 30, 2024, it is still recommended to familiarize yourself with these changes by referring to our Client Alert on the subject, which can be found here.

Other Filings and General Tips

While in the season of annual reporting, it is recommended to keep other filings in mind as well. Foreign private issuers using Form F-3 and U.S. domestic issuers using form S-3 for shelf offerings (including smaller issuers with a public float below $75 million that are planning to use the same for a “Baby Shelf”) should make sure they are meeting all of their requirements, such as timely filing of the required Exchange Act reports during the 12 months prior to the filing. Clients with an ATM Program should be mindful that the filing of an annual report may trigger the requirement to provide a bringdown comfort letter, depending on the terms of the particular program.

Annual reporting season is also a good time to check on your status as a well-known seasoned issuer or emerging growth company, if applicable. Clients should also consider addressing certain general corporate matters, such as nominations, new chairman, new committees/committee members, evaluating authorized share cap, amending or increasing total authorized shares under equity incentive plans, confirming the expiration dates of existing shelf registration statements or shareholder rights plan, etc.

Closing Thoughts

In the coming weeks, please be in touch with your Seward & Kissel attorney about next steps regarding the drafting and filing of 2023 annual reports and proxy statements, as well as any other general corporate matters. This is a good time to start planning who will prepare the different portions of your annual report as well as beginning conversations with your auditor.

If you have any question regarding the foregoing, please contact either of the partners listed below or your primary Seward & Kissel attorney.