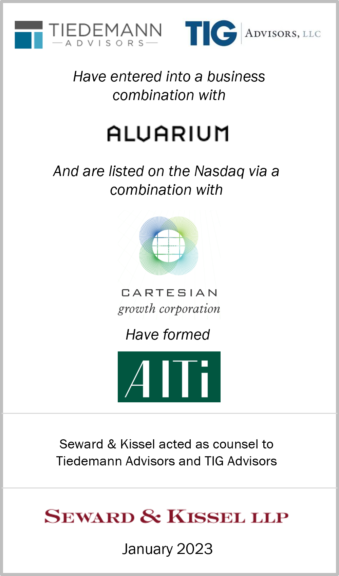

On January 3, 2023, Tiedemann Group (“Tiedemann”), Alvarium Investments Limited (“Alvarium”) and Cartesian Growth Corporation (“Cartesian”) (NASDAQ: GLBL) announced that they have completed their previously announced business combination to operate as Alvarium Tiedemann Holdings, Inc. (“Alvarium Tiedemann” or “AlTi”). Seward & Kissel is pleased to have represented Tiedemann Advisors and TIG Advisors in connection with this investment management industry transaction.

Tiedemann Advisors is an independent investment and wealth advisor for high-net-worth individuals, family offices, trusts, foundations and endowments. TIG Advisors is a New York-based alternative asset manager with approximately $7 billion in assets under management (inclusive of assets under management of its affiliated managers), focused on making growth equity investments in global alternative specialists. Alvarium is an independent investment firm, global multi-family office and merchant banking boutique providing tailored solutions for families, foundations and institutions across the Americas, Europe and Asia-Pacific. Cartesian Growth Corporation (“CGC”) is an affiliate of Cartesian Capital Group, LLC, a global private equity firm and registered investment adviser headquartered in New York City, New York.

Seward & Kissel LLP (www.sewkis.com) is a leading New York law firm, originally established in 1890, offering legal advice emphasizing business, financial and commercial law and related litigation. The firm’s Business Transactions Group handles middle-market M&A, private equity, venture capital and joint venture transactions involving a wide variety of industries. The firm is ranked as Highly Regarded for Corporate/M&A by Chambers USA and is recommended by The Legal 500 in the middle-market M&A category, stating that Seward & Kissel “advises on market-leading transactions within the industries where the firm has an international reputation, namely investment management and shipping.”

The company’s press release describing this transaction is available here.