On November 2, 2020, the Securities and Exchange Commission (“SEC”) adopted amendments to the exempt offering framework.1 In addition to seeking to close gaps and reduce complexities, the amendments are intended to simplify, harmonize and improve certain aspects of the framework to promote capital formation while preserving or enhancing investor protections. Specifically, the amendments (i) seek to modernize and simplify the integration framework for registered and exempt offerings, (ii) seek to set clear and consistent rules governing offering communications between issuers and investors, (iii) increase offering and investment limits for Regulation A, Regulation Crowdfunding, and Rule 504 offerings, and (iv) harmonize certain disclosure and eligibility requirements and bad actor disqualification provisions. The amendments will go into effect sixty days after publication in the Federal Register.2

This Memorandum addresses the portions of the adopting release and the related rules that we believe will have the greatest impact on our Investment Management clients and friends, including: (i) the changes to the integration framework, (ii) the SEC’s discussion of pre-existing substantive relationships, (iii) the changes to, and the SEC’s discussion of, Rule 506(c) verification requirements, and (iv) the new “testing-the-waters” offering exemption.3

New Integration Framework

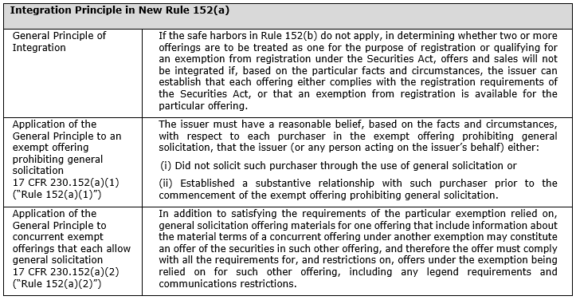

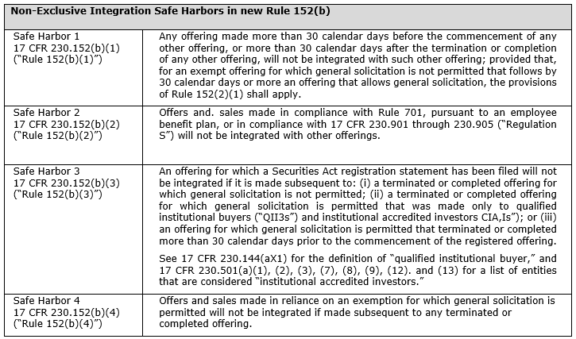

The integration doctrine seeks to prevent an issuer from improperly avoiding registration by artificially dividing a single offering into multiple offerings such that exemptions from registration would apply to the multiple offerings that would not be available for the combined offering. The existing integration framework consists of a mixture of rules and SEC guidance. As part of the rule amendments, the SEC enacted Rule 152, building on the approach to integration in the SEC’s recent rulemakings and providing a comprehensive integration framework composed of a general principle of integration and four safe harbors applicable to both registered and exempt securities offerings. The tables attached hereto as Appendix A, excerpted from the adopting release, set out the new integration framework.

Of particular note for our Investment Management clients and friends, the safe harbor set out in new Rule 152(b)(1) provides that any offering made more than 30 days after the termination or completion of any other offering will generally not be integrated with such other offering. This represents a significant change from the current integration safe harbor that provides for a six-month safe harbor time period, with the effect that private funds will now be able to more quickly and more safely engage in separate offerings, including in order to utilize different offering exemptions (such as Rule 506(b) and Rule 506(c)4).

In addition, the Rule 152(b)(2) safe harbor codifies the long-standing SEC position that offshore transactions made in compliance with Regulation S will not be integrated with domestic offerings that satisfy the requirements for an exemption from registration. As a result, private funds that engage in concurrent Regulation D and Regulation S offerings (such as an offshore feeder fund that concurrently offers its interests to U.S. tax-exempt investors under Regulation D and to non-U.S. investors under Regulation S) can continue to do so with certainty that the two offerings will not be integrated as long as each transaction separately complies with the applicable exemption.

Pre-existing Substantive Relationships

In the course of describing the new integration framework, the SEC reiterated its prior guidance that it generally views a “pre-existing” relationship as one that the issuer has formed with an offeree prior to the commencement of the offering or, alternatively, that was established through another person (for example, a registered broker-dealer or investment adviser) prior to that person’s participation in the offering, and that a “substantive” relationship is one in which the issuer (or a person acting on its behalf) has sufficient information to evaluate, and does, in fact, evaluate, an offeree’s financial circumstances and sophistication, in determining his or her status as an accredited or sophisticated investor. The SEC also noted that investors with whom the issuer has a pre-existing substantive relationship may include the issuer’s existing or prior investors, investors in prior deals of the issuer’s management, or friends or family of the issuer’s control persons. Similarly, such investors may also include customers of a registered broker-dealer or investment adviser with whom the broker-dealer or investment adviser established a substantive relationship prior to the participation in the exempt offering by the broker-dealer or investment adviser.

Notably, the SEC stated in the adopting release that it does not believe that self-certification alone (by checking a box) without any other knowledge of a person’s financial circumstances or sophistication would be sufficient to form a “substantive” relationship. The SEC noted that it recognizes that there may be particular instances where issuers may develop pre-existing substantive relationships with offerees. However, in the absence of a prior business relationship or a recognized legal duty to offerees, it is likely more difficult for an issuer to establish a pre-existing, substantive relationship.5 Issuers would have to consider not only whether they have sufficient information about particular offerees, but also whether they in fact use that information appropriately to evaluate the financial circumstances and sophistication of the offerees prior to commencing the offering.

The main consideration for our Investment Management clients and friends on this point is that when seeking to establish a pre-existing, substantive relationship with a prospective offeree, for example through the use of a questionnaire, it is critical to gather and use the relevant information to affirmatively evaluate such person’s financial circumstances and sophistication and to formally document such evaluation. It is not enough to rely on self-certification alone. While not specifically addressed in the adopting release, a questionnaire used for these purposes should, at a minimum, request specific information regarding a prospective offeree’s business experience, investment experience and assets, and the issuer should document its evaluation of the questionnaire and any subsequent communications or follow-up with the prospective offeree. Importantly, this guidance relates to the establishment of a pre-existing substantive relationship and should therefore not affect the ability of an issuer to reasonably rely on an investor’s subscription agreement representations in a Rule 506(b) offering.

Rule 506(c) Verification Requirements

Enacted in 2013, the Rule 506(c) offering exemption permits a private fund to generally solicit and advertise an offering, provided that all purchasers in the offering are accredited investors, the issuer takes reasonable steps to verify that purchasers are accredited investors, and certain other conditions of Regulation D are satisfied. Rule 506(c) provides a principles-based method for verification as well as a non-exclusive list of verification methods. The SEC’s amendments to Rule 506(c) add a new item to this non-exclusive list and permit an issuer to establish that an investor that the issuer previously took reasonable steps to verify as an accredited investor remains an accredited investor as of the time of a subsequent sale if the investor provides a written representation that the investor continues to qualify as an accredited investor and the issuer is not aware of information to the contrary. Such written representation will satisfy the issuer’s verification obligations for a period of five years from the date the person was previously verified as an accredited investor.

In addition, the SEC reaffirmed and updated its prior guidance with respect to the principles-based methods for verification, and in particular what may be considered “reasonable steps” to verify an investor’s accredited investor status, in order to reduce concerns that an issuer’s method of verification may be second guessed by regulators or other market participants. The SEC noted that the principles-based method was intended to provide issuers with significant flexibility in deciding the steps needed to verify a person’s accredited investor status, and that in some circumstances, the reasonable steps determination under Rule 506(c) may not be substantially different from an issuer’s development of a “reasonable belief” for Rule 506(b) purposes. For example, an issuer’s receipt of an investor representation as to his or her accredited investor status could meet the “reasonable steps” requirement if the issuer reasonably takes into consideration a prior substantive relationship with the investor or other facts that make apparent the accredited investor status of the investor. The SEC cautioned, however, that the same representation from another investor may not meet the “reasonable steps” requirement if the issuer has no other information about the investor.

The SEC’s guidance in the adopting release clearly signals that in most circumstances the SEC does not currently intend to second-guess an issuer’s determination of what constitutes “reasonable steps” to verify a purchaser’s accredited investor status in a Rule 506(c) offering, provided that the issuer has considered its particular facts and circumstances in establishing a reasonable basis for its determination. Since concern about the possible subjectivity about the “reasonable steps” requirement has prevented some issuers from relying on Rule 506(c), this guidance (together with the changes to the integration framework discussed above) may result in more Rule 506(c) offerings by private funds.

New “Testing-the-Waters” Offering Exemption

Another notable aspect of the adopting release is the SEC’s expansion of permissible communications in private offerings. Rule 241 is a new offering exemption for “testing-the-waters” and permits an issuer to use generic solicitation of interest materials for an offer of securities prior to making a determination as to the exemption under which the offering may be conducted.6 The new rule allows issuers to use generic solicitation of interest materials and to communicate orally or in writing to determine whether there is any interest in a contemplated exempt offering without violating the prohibitions on offers prior to filing a registration statement (or complying with an offering exemption), provided the issuer complies with the requirements of the rule.7 “Testing-the-waters” communications are subject to the anti-fraud provisions of the Federal securities laws and importantly, Rule 241 does not preempt State blue sky laws.

Although Rule 241 appears promising for private funds, the lack of State blue sky law preemption means that an issuer relying on Rule 241 will need to evaluate, on a state-by-state basis, whether its testing-the-waters communications comply with State blue sky laws. As a result, private fund managers who wish to engage in testing-the-waters communications with prospective investors with whom they do not have a pre-existing substantive relationship may ultimately conclude that conducting a Rule 506(c) offering is a safer course of action, given that Rule 506(c) preempts State blue sky laws. The adopting release does leave open the possibility that the SEC may revisit State law preemption based on feedback on how State regulation affects the use of generic solicitations of interest under Rule 241.

* * * * *

If you have any questions regarding the information discussed above, please contact your Investment Management Group attorney at Seward & Kissel LLP.

* * * * *

APPENDIX A: New Integration Framework (excerpted from the adopting release)