The purpose of this Article is to help guide the smaller operating businesses, holding companies, family-owned limited liability companies (including single-member LLCs), and entities formed for purposes of acquisitions, joint ventures, or other strategic partnerships that we believe will be most affected by the new Corporate Transparency Act reporting requirements. This Article discusses the exemptions that may be most applicable for strategic acquirors, investors, and business owners, and, to the extent an exemption is not available, the process to identify “Beneficial Owners” who must be reported.

Background

Effective as of January 1, 2024, the Corporate Transparency Act (the “CTA”), a set of new regulations being implemented by the Financial Crimes Enforcement Network (“FinCEN”), requires entities that are formed or registered to do business in the United States and that do not qualify for applicable exemptions (“Reporting Companies”) to submit a report declaring beneficial ownership information (a “BOI Report”) to FinCEN. These reporting obligations are part of the U.S. government’s efforts to promote transparency and limit opportunities for money laundering and other criminal activity committed through shell companies or other opaque ownership structures. By way of the BOI Reports, a federal database will be created with beneficial ownership information about Reporting Companies. Reporting violations can lead both to civil and criminal penalties.

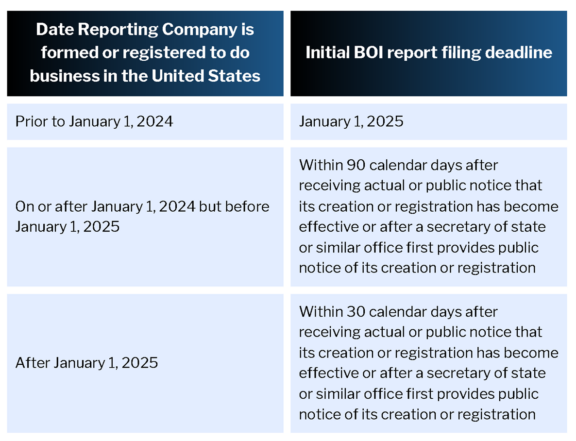

Deadlines

Reporting Companies that are formed or registered to do business on or after January 1, 2024 must submit a BOI Report within 90 days of such formation or registration. However, after January 1, 2025, new Reporting Companies will only have 30 days to submit a BOI Report. Reporting Companies that were formed or registered to do business in the U.S. prior to January 1, 2024, have one year, until January 1, 2025, within which to submit a BOI Report.

Who Is Affected

The CTA covers both domestic and foreign entities. Domestic Reporting Companies include corporations, limited liability companies, limited partnerships, and any other entity formed by filing a document with a U.S. state’s secretary of state. Foreign Reporting Companies include corporations, limited companies, and other entities formed under non-U.S. law that are registered to do business in any state in the United States.

The CTA currently provides twenty-three exemptions under which a company will not be considered a Reporting Company and will therefore not be required to file a BOI Report with FinCEN (an “Exempt Entity”). Public companies, certain private investment funds, broker/dealers, registered investment companies, registered investment advisers, and other large and already regulated companies will be exempt. FinCEN has published a Small Entity Compliance Guide, which includes checklists for each of the 23 exemptions (see Chapter 1.2, “Is my company exempt from the reporting requirements?”) Companies should carefully review the qualifying criteria, and, if desired, consult with legal counsel, before concluding that they are exempt.

Applicable Exemptions

Certain business owners, investors, and acquirors, depending on the structure of their organizations, may find the exemptions listed below helpful.

Large Operating Companies. A “Large Operating Company” that meets all of the following criteria would be an Exempt Entity:

- The entity employs more than 20 full time employees in the United States. In general, “full-time employee” means, with respect to a calendar month, an employee who is employed an average of at least 30 hours of service per week with an employer.

- The entity has an operating presence at a physical office within the United States. The physical office may be owned or leased, but, in either case, must be physically distinct from the place of business of any other unaffiliated entity.

- The entity filed a federal income tax or information return1 in the United States for the previous year demonstrating more than $5,000,000 in gross receipts or sales (excluding any gross receipts or sales from outside the United States).2

Investment Advisers. SEC-registered investment advisers (“RIAs”)3 and venture capital fund advisers4 are exempt from the definition of Reporting Company.

Private Fund General Partners/Managing Members. Under certain circumstances, the general partner or managing member of a private fund that is affiliated with an RIA may qualify for an exemption from the CTA requirements as an RIA or otherwise. However, this must be evaluated on a case-by-case basis.

Pooled Investment Vehicles. A U.S. private fund relying on an exclusion from the definition of investment company in Section 3(c)(1) or Section 3(c)(7) of the Investment Company Act of 1940, as amended, that is operated or advised by an RIA or a venture capital fund adviser (or other qualifying entities), and that is identified by its legal name by the applicable investment adviser in its Form ADV filed with the SEC (or will be identified in the next annual updating amendment to Form ADV required to be filed by the applicable investment adviser) is exempt and not required to file a BOI Report.

More information on the application of the CTA to investment advisers and related entities can be found here.

Subsidiaries. Any entity whose ownership interests are wholly controlled or wholly owned, directly or indirectly, by certain Exempt Entities, including an RIA, venture capital fund adviser or large operating company, is itself exempt from the CTA reporting requirements. There is no specific exemption covering subsidiaries of entities exempt under the pooled investment vehicle exemption, such as special purpose vehicles and alternative investment vehicles. Therefore, these types of entities may be required to file a BOI Report (unless another exemption can be applied).

Other Considerations. Any entity acting as a holding company may be required to file a BOI Report. For example, while an RIA or large operating company may itself be an Exempt Entity, an entity that directly or indirectly owns or controls the RIA or large operating company is not exempt unless another exemption applies. A holding vehicle that has been formed to act as the managing member of an Exempt Entity may be a Reporting Company.

More information on the remainder of the 23 exemptions from the CTA requirements can be found here.

Beneficial Owners

If a company is determined to be a Reporting Company under the CTA, all “Beneficial Owners” of the Reporting Company must be identified, and their information reported by the Reporting Company to FinCEN. The CTA defines a Beneficial Owner of a Reporting Company as any natural person who directly or indirectly (i) exercises “substantial control” over the Reporting Company or (ii) owns or controls 25% or more of the ownership interests of the Reporting Company.

An individual might be a Beneficial Owner through substantial control, ownership interests, or both. Reporting Companies are not required to report the reason (i.e., substantial control or ownership interests) that an individual is a Beneficial Owner.

FinCEN expects that every Reporting Company would be substantially controlled by at least one individual, and therefore that every Reporting Company will be able to identify and report at least one Beneficial Owner. There is no maximum number of Beneficial Owners who must be reported.

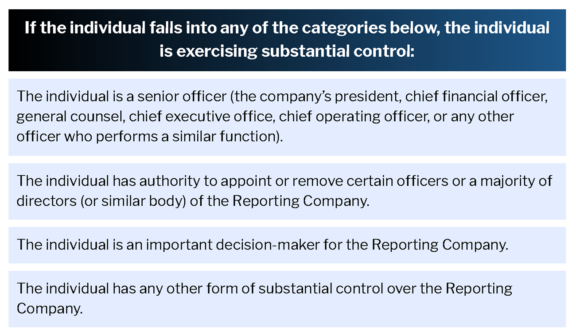

Substantial Control

Individuals with “Substantial Control” over a Reporting Company include those who (i) serve as a manager or senior officer, such as a president, CEO, CFO, COO, or general counsel, (ii) have the right to appoint or remove any such manager or senior officer, or appoint or remove a majority of the board of directors or similar governing body, (iii) are an important decision-maker (including by owning or controlling a majority of voting power), or (iv) otherwise have any other form of substantial control over the Reporting Company (which may be in the form of contractual rights).

Substantial control may be exercised by way of controlling one or more intermediary entities that separately or collectively exercise substantial control over a Reporting Company. Substantial control can also take the form of financial or business relationships.

An important decision-maker would include any individual who has influence over the Reporting Company’s (i) business, including business lines, ventures, or geographic focus, or the entry or termination of significant contracts, (ii) finances, including the sale or lease of principal assets, major expenditures of investments, issuances of equity, incurrence of debt, or approval over the operating budget, or (iii) structure, including the reorganization, dissolution, or merger of the Reporting Company, or amendments to its governing documents.

If an individual is solely an employee of the Reporting Company and only exerts control as a result of such employment status (and not, for the avoidance of doubt, by being a senior officer of the company) then such individual may be exempt from being deemed a Beneficial Owner. Individuals who are creditors of the Reporting Company may also be exempt so long as their entitlement to payment is their only interest in the Reporting Company, even if such creditors benefit from corresponding loan covenants and similar rights over the business in relation to securing their right to receive payment.

Ownership

Determining whether a Beneficial Owner owns or controls 25% or more of the ownership interests in the Reporting Company takes direct and indirect ownership into account, and includes all equity, stock, units, interests in joint ventures, voting rights, capital and profits interests, as well as any rights to purchase these, and any other instrument, contract, or mechanism used to establish ownership. Further, the determination treats options, warrants, convertible instruments, and similar equity rights as being exercised. The determination may be simple for some businesses and very complex in other business structures. Ultimately, the ownership test will require Reporting Companies to go “up the chain” of their organizational structures to determine the natural persons who are Beneficial Owners. When completing the calculations for the 25% test, consider the following guidance from FinCEN:

1. Corporations. If the Reporting Company is a corporation or treated as a corporation for federal income tax purposes (including a subchapter S corporation) and certain shares of stock issued by such corporation have more voting power or represent more of the value of the corporation than other shares (e.g., Series A shares with one vote per share and Series B shares with ten votes per share), the Beneficial Owners would be determined by reference to the larger of the following two ownership percentage calculations:

- Voting Power Percentage: (i) Total combined voting power of all classes of ownership interests held by the applicable stockholder divided by (ii) total outstanding voting power of all classes of ownership interests entitled to vote.

- Ownership Interest Value Percentage: (i) Total combined value of the ownership interests held by the applicable stockholder divided by (ii) total outstanding value of all ownership interests.

2. Partnerships. If the Reporting Company is treated as a partnership for federal income tax purposes, capital and profits interests should be combined when making the calculation (for purposes of determining both an equityholder’s ownership interests and all outstanding ownership interests).

3. Other. If the above situations do not apply, each individual who ultimately owns or controls 25% or more of any class or type of ownership interest would be deemed a Beneficial Owner.

Beneficial Owners who are Exempt Entities

If a Reporting Company’s Beneficial Owners hold their ownership interest solely through Exempt Entities (i.e., an entity that, in its own right, meets one of the 23 qualifying exemptions), then the ultimate individual owners of such Exempt Entities do not need to be reported to FinCEN by the Reporting Company. Instead, the Reporting Company would only include in its BOI Report the names of the Exempt Entities.

***

For recommendations on policies and procedures your organization may wish to implement, and other practical guidance in respect of the CTA, please refer to our article “Corporate Transparency Act: Best Practices Part 1.”

For guidance regarding language a Reporting Company may wish to include into its governing documents, please refer to our article “Corporate Transparency Act: Best Practices Part 2.”

Please reach out to your Seward & Kissel relationship attorney or a member of the S&K Corporate Transparency Act Committee if you would like more information regarding (i) the information that must be included in the BOI Report about “Beneficial Owners” and “Company Applicants,” (ii) how to submit the BOI Report, (iii) applicable exemptions from the CTA requirements that may not be covered here, and (iv) any other information regarding the CTA. Seward & Kissel can help you navigate this new law and its compliance obligations. We will share more information on the CTA and reporting requirements as these become available.

*Update*

On March 1, 2024, a federal district court in the Northern District of Alabama5, entered a final declaratory judgment, concluding that the Corporate Transparency Act exceeds the Constitution’s limits on Congress’s power and enjoining the Department of the Treasury and FinCEN from enforcing the Corporate Transparency Act against the plaintiffs in the case. The Justice Department, on behalf of the Department of the Treasury, filed a Notice of Appeal on March 11, 2024 and issued a public release stating that while the litigation is ongoing, FinCEN will continue to implement the Corporate Transparency Act as required by Congress, and would comply with the court’s order solely with respect to the particular individuals and entities subject to the court’s injunction. Otherwise, FinCEN’s continuing guidance is that reporting companies are still required to comply with the law and file beneficial ownership reports as provided in FinCEN’s regulations.

To view a pdf of this alert, please click here.